Generally, in the analyses of Africa’s realities two opposing dogmatic approaches prevail: chronic Afro-pessimism and complacent Afro-optimism. There is a certain tendency to understand Africa as a uniform, homogenous whole, with similar economic and socio-political dynamics, sometimes to the point of considering it as a country and not a continent. There is also this catastrophic vision of Africa as it is just hunger, war, and death. The continent has been stereotyped in the negative light by some of the tragic images and occurrences. It is necessary to move away from these paradigms towards Afro-realism which consists in explaining those realities and all the opportunities Africa must make the most of.

Africa’s demographic trends

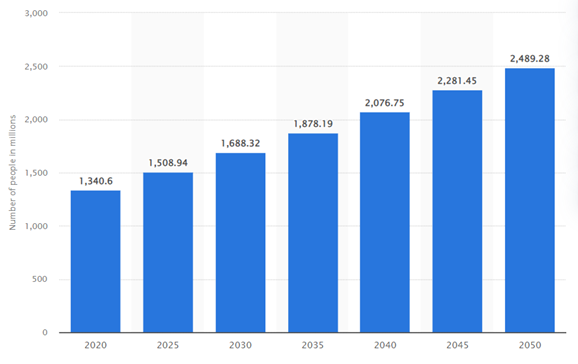

Africa is the world’s youngest continent with most rapidly growing population and a net contributor to the world’s population as the other continents are slowing down or shrinking in terms of population. In fact, the world is becoming more African and rapidly. Projections show that by 2050 Africa’s population will almost double. Africa’s current population is 1.4 billion people (257 million people in North Africa and 1.2 billion people in Sub-Saharan Africa) while it is expected to grow up to 2.5 billion people by 2050. By 2100, one in three people on Earth will be African.

Forecast of the total population of Africa from 2020 to 2050 (in millions)

Africa’s demographic trends

Africa is the world’s youngest continent with most rapidly growing population and a net contributor to the world’s population as the other continents are slowing down or shrinking in terms of population. In fact, the world is becoming more African and rapidly. Projections show that by 2050 Africa’s population will almost double. Africa’s current population is 1.4 billion people (257 million people in North Africa and 1.2 billion people in Sub-Saharan Africa) while it is expected to grow up to 2.5 billion people by 2050. By 2100, one in three people on Earth will be African.

Forecast of the total population of Africa from 2020 to 2050 (in millions)

Source: Statista 2023

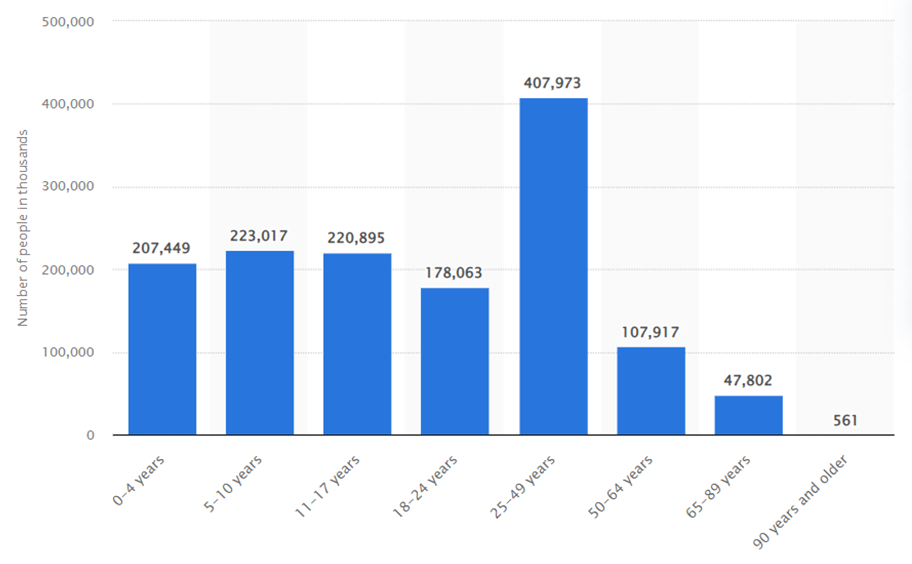

In most African countries, 70% or more of the population is under the age of 30. This means that, by the end of the century, sub-Saharan Africa will be home to almost half of the young people in the world. To give an example, in 2021, there were around 207 million children aged 0-4 years in Africa. In total, the population aged 17 years and younger amounted to approximately 650 million. In contrast, only approximately 48 million individuals were aged 65 years and older as of the same year.

Population of Africa in 2021, by age group (in 1,000s)

In most African countries, 70% or more of the population is under the age of 30. This means that, by the end of the century, sub-Saharan Africa will be home to almost half of the young people in the world. To give an example, in 2021, there were around 207 million children aged 0-4 years in Africa. In total, the population aged 17 years and younger amounted to approximately 650 million. In contrast, only approximately 48 million individuals were aged 65 years and older as of the same year.

Population of Africa in 2021, by age group (in 1,000s)

Source: Statista 2023

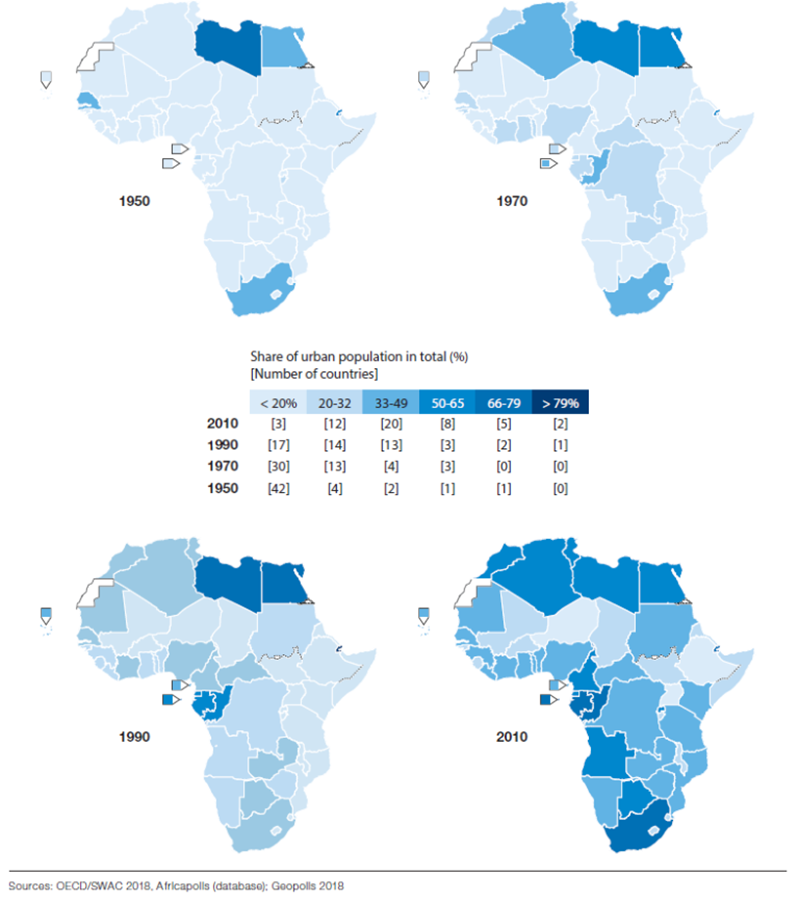

In addition to be the youngest continent of the world, Africa is also the most rapidly urbanizing part of the world. In fact, Africa is projected to have the fastest urban growth rate in the world: by 2050, Africa’s cities will be home to an additional 950 million people welcoming two-thirds of Africa’s population.

The evolution of urbanization in Africa, 1950-2010

Urbanization is one of the most profound transformations that the African continent will undergo in the 21st century. Since 1990, the number of cities in Africa has doubled — from 3 300 to 7 600 — and their cumulative population has increased by 500 million people. Urbanization presents immense economic, social, and political opportunities for Africa’s cities, but it also entails very important challenges. Such an urban expansion will not only demand planning, managing and financing of infrastructure and public services, but it will also require strategies promoting employment, stimulating green technology uptake and digitalization, and ensuring climate neutrality and sustainability.

In addition to be the youngest continent of the world, Africa is also the most rapidly urbanizing part of the world. In fact, Africa is projected to have the fastest urban growth rate in the world: by 2050, Africa’s cities will be home to an additional 950 million people welcoming two-thirds of Africa’s population.

The evolution of urbanization in Africa, 1950-2010

Urbanization is one of the most profound transformations that the African continent will undergo in the 21st century. Since 1990, the number of cities in Africa has doubled — from 3 300 to 7 600 — and their cumulative population has increased by 500 million people. Urbanization presents immense economic, social, and political opportunities for Africa’s cities, but it also entails very important challenges. Such an urban expansion will not only demand planning, managing and financing of infrastructure and public services, but it will also require strategies promoting employment, stimulating green technology uptake and digitalization, and ensuring climate neutrality and sustainability.

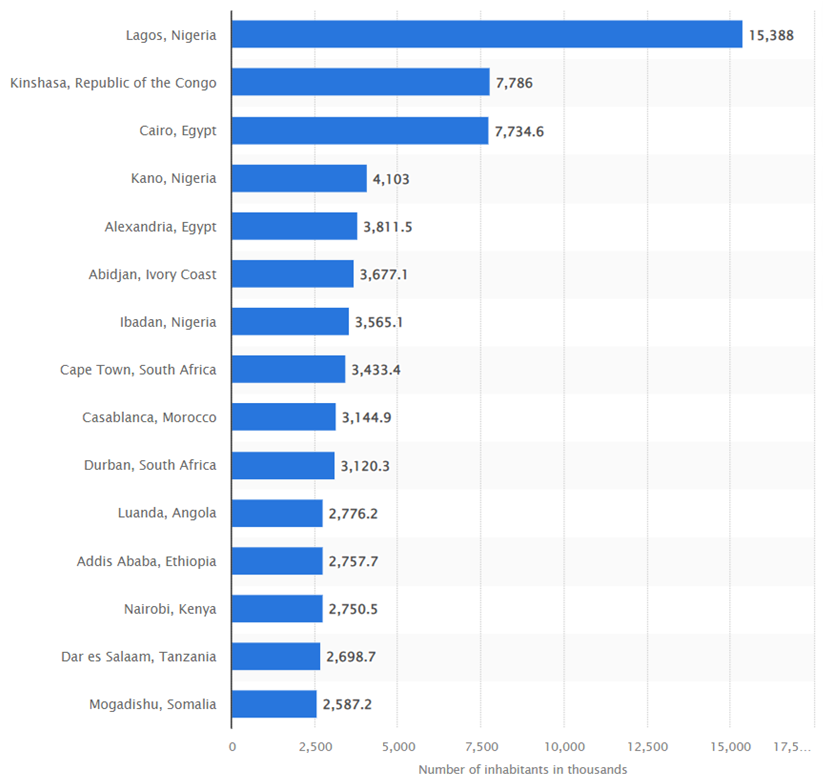

Rapid urbanization has also fueled the rise of megacities. Nigeria is Africa’s most populous country and its largest economy. Based on current growth rates, Nigeria’s largest city, Lagos, could even emerge as the world’s top megacity by the end of the century. Across the rest of Africa, there are gigantic cities that are growing very quickly, organically, and a lot of the trade is increasingly within Africa.

Largest cities in Africa as of 2022, by number of inhabitants (in 1,000s)

Largest cities in Africa as of 2022, by number of inhabitants (in 1,000s)

Source: Statista 2023

Africa’s rapid urbanization process is changing the urban geography of the continent. While urbanization rates were low, African cities were located far from each other and served primarily as administration centers and gateways for resource exports to global markets. As the number of cities in Africa grows, cities are increasingly located close to each other. This has led to the development of clusters of cities.

In 2015, Africa had 31 city clusters with more than 2.5 million urban residents within 100 kilometers of each other, and six city clusters with more than 10 million urban residents within 250 kilometers. City clusters provide new opportunities for economic development like creation of an economic ecosystem of customers, suppliers, investors, and innovators that is much larger than that of any individual city. This particularly benefits small and intermediary cities that do not have the economic mass to attract major private investments.

While a transformation on the scale of Africa’s urbanization necessarily has its downsides, they are outweighed by the economic opportunities and by the improved living standards that cities generate. Some of the most important clusters of cities span multiple countries. These clusters stand to benefit from the reduction in trade barriers after the implementation of the African Continental Free Trade Agreement (AfCFTA). Yet even cities beyond cross‑border clusters can be major beneficiaries of the AfCFTA. In particular, the reduction in intra‑African trade barriers will benefit the tradable sector in cities and will reduce prices for urban consumers. However, the opportunities offered by implementation of the AfCFTA need to be matched by cross‑border infrastructure investments and other measures to promote trade.

Africa’s recent macroeconomic performance

Following the impressive recovery in 2021 after the shock of the COVID-19 pandemic, African economies slowed amid significant headwinds in 2022, but they remain resilient with a stable outlook. The slowdown in economic growth has been due to a confluence of factors, including the growing impacts of climate change, persistent COVID-19 risks in Africa and globally, and the spillover effects of rising geopolitical tensions.

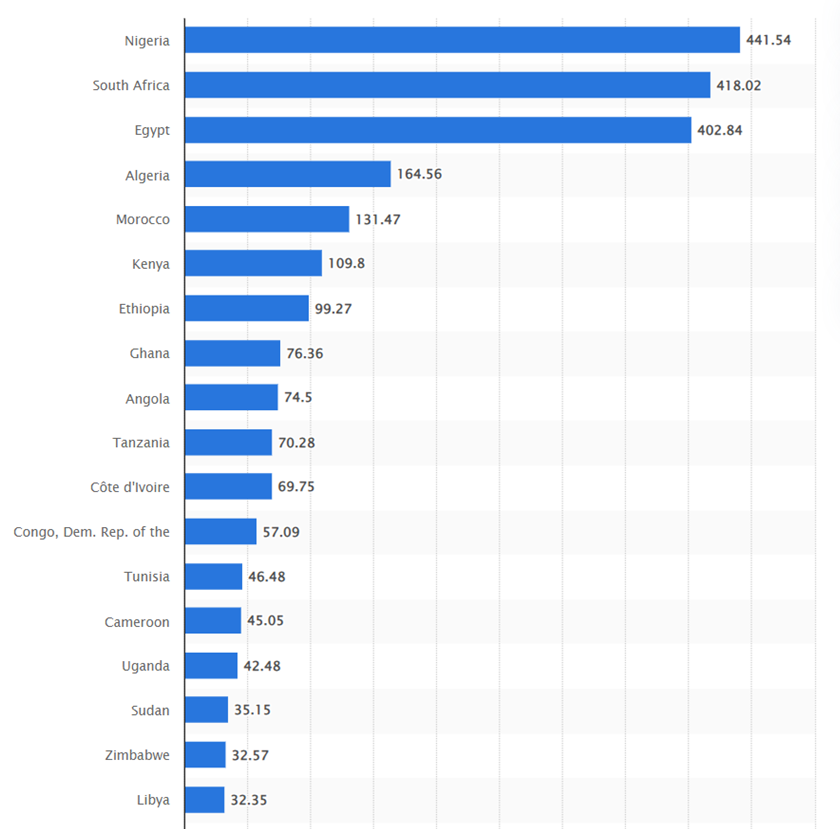

African countries with the highest Gross Domestic Product (GDP) in 2021

Africa’s rapid urbanization process is changing the urban geography of the continent. While urbanization rates were low, African cities were located far from each other and served primarily as administration centers and gateways for resource exports to global markets. As the number of cities in Africa grows, cities are increasingly located close to each other. This has led to the development of clusters of cities.

In 2015, Africa had 31 city clusters with more than 2.5 million urban residents within 100 kilometers of each other, and six city clusters with more than 10 million urban residents within 250 kilometers. City clusters provide new opportunities for economic development like creation of an economic ecosystem of customers, suppliers, investors, and innovators that is much larger than that of any individual city. This particularly benefits small and intermediary cities that do not have the economic mass to attract major private investments.

While a transformation on the scale of Africa’s urbanization necessarily has its downsides, they are outweighed by the economic opportunities and by the improved living standards that cities generate. Some of the most important clusters of cities span multiple countries. These clusters stand to benefit from the reduction in trade barriers after the implementation of the African Continental Free Trade Agreement (AfCFTA). Yet even cities beyond cross‑border clusters can be major beneficiaries of the AfCFTA. In particular, the reduction in intra‑African trade barriers will benefit the tradable sector in cities and will reduce prices for urban consumers. However, the opportunities offered by implementation of the AfCFTA need to be matched by cross‑border infrastructure investments and other measures to promote trade.

Africa’s recent macroeconomic performance

Following the impressive recovery in 2021 after the shock of the COVID-19 pandemic, African economies slowed amid significant headwinds in 2022, but they remain resilient with a stable outlook. The slowdown in economic growth has been due to a confluence of factors, including the growing impacts of climate change, persistent COVID-19 risks in Africa and globally, and the spillover effects of rising geopolitical tensions.

African countries with the highest Gross Domestic Product (GDP) in 2021

Source: Statista 2023

Most African economies were impacted by tightening financial conditions and the appreciating US dollar as these factors have increased the cost of servicing existing debt and heightened the risk of debt distress. They have also restricted access to international capital markets for new financing to meet fiscal needs and have greatly amplified instability in foreign exchange markets. The estimated average growth of real gross domestic product (GDP) slowed to 3.8 percent in 2022 from 4.8 percent in 2021—and is projected to stabilize at 4 percent over 2023 - 2024. The slowdown reflects the confluence of the domestic and external shocks highlighted above.

The stable outlook projected for 2023 - 2024 reflects continuing policy support in Africa and global efforts to mitigate the impact of external shocks and rising uncertainty. China’s anticipated reopening after three years of zero COVID policy and the stable growth outlook for Asia could bolster Africa’s growth in the medium term.

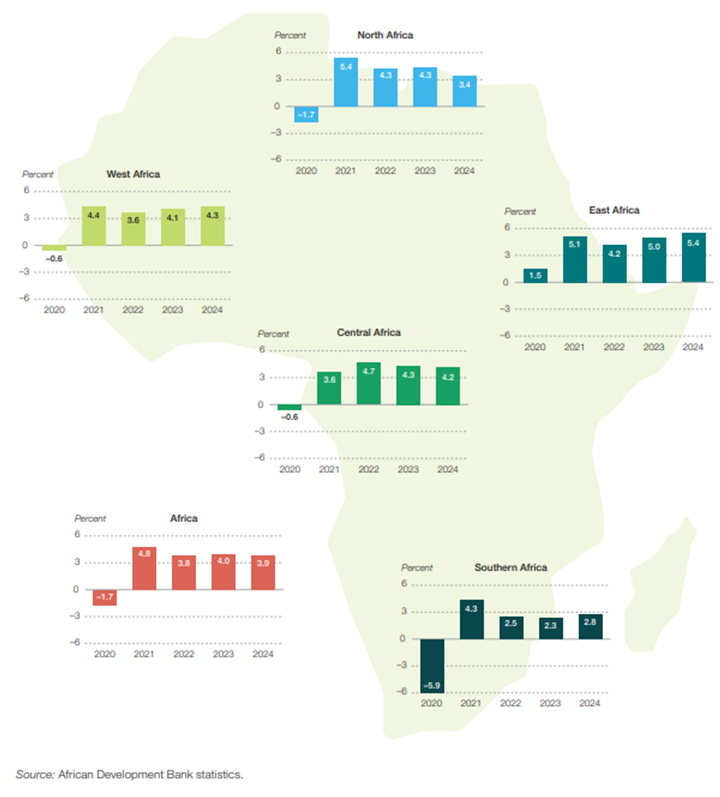

Africa’s growth performance and outlook, by region, 2020 - 2024

Most African economies were impacted by tightening financial conditions and the appreciating US dollar as these factors have increased the cost of servicing existing debt and heightened the risk of debt distress. They have also restricted access to international capital markets for new financing to meet fiscal needs and have greatly amplified instability in foreign exchange markets. The estimated average growth of real gross domestic product (GDP) slowed to 3.8 percent in 2022 from 4.8 percent in 2021—and is projected to stabilize at 4 percent over 2023 - 2024. The slowdown reflects the confluence of the domestic and external shocks highlighted above.

The stable outlook projected for 2023 - 2024 reflects continuing policy support in Africa and global efforts to mitigate the impact of external shocks and rising uncertainty. China’s anticipated reopening after three years of zero COVID policy and the stable growth outlook for Asia could bolster Africa’s growth in the medium term.

Africa’s growth performance and outlook, by region, 2020 - 2024

Despite the confluence of multiple shocks, growth across all five African regions was positive in 2022—and the outlook for 2023 - 2024 is projected to be stable. To become more resilient to global economic slowdown and considerable global uncertainty African countries need to boost regional trade and build a more vibrant regional market in the medium to long term. That requires accelerating investments in regional hard and soft infrastructure, including regional transport and logistics. It also requires promoting the free movement of goods and services by removing trade and nontrade barriers. And it requires strengthening African payment systems. With the recent disruptions in global supply chains and calls for reshoring and friend-shoring trade, the African Continental Free Trade Area presents a major opportunity for countries to internalize shocks while improving their trade balances and building economic resilience.

AfCFTA – the African Continental Free Trade Area

The African Continental Free Trade Area (AfCFTA) is Africa’s most ambitious integration initiative and a flagship project of Agenda 2063 of the African Union — Africa’s own development vision. It brings together the 55 countries of the African Union (AU) and eight (8) Regional Economic Communities (RECs). It was approved by the 18th ordinary Session of Assembly of Heads of State and Government, held in Addis Ababa, Ethiopia in January 2012 which adopted the decision to establish a Continental Free Trade Area.

The AfCFTA aims at accelerating intra-African trade and boosting Africa’s trading position in the global market by strengthening Africa’s common voice and policy space in global trade negotiations. The overall mandate of the AfCFTA is to create a single continental market with a population of about 1.3 billion people and a combined GDP of approximately US$ 3.4 trillion.

The objectives of the AfCFTA are the following:

· To create a single market for goods, services, facilitated by movement of persons to deepen the economic integration of the African continent and in accordance with the Pan African Vision enshrined in Agenda 2063.

· To create a liberalized market for goods and services through successive rounds of negotiations.

· To contribute to the movement of capital and natural persons and facilitate investments building on the initiatives and developments in the State Parties and RECs.

· To lay the foundation for the establishment of a Continental Customs Union at a later stage.

· To promote and attain sustainable and inclusive socio-economic development, gender equality and structural transformation of the State Parties.

· To enhance the competitiveness of the economies of State Parties within the continent and the global market.

· To promote industrial development through diversification and regional value chain development, agricultural development, and food security.

· To resolve the challenges of multiple and overlapping memberships.

The AfCFTA entered into force on May 30, 2019, after 24 Member States deposited their Instruments of Ratification following a series of continuous continental engagements spanning since 2012. The commencement of trading under the AfCFTA was on January 1, 2021.

The implementation of the AfCFTA comprises two phases:

Phase I:

· trade in goods

· trade in services

· dispute settlement mechanism

Phase II:

· investment

· intellectual property rights

· competition policy

· digital trade

· women and youth in trade

The AfCFTA will contribute to establishing regional value chains in Africa, boosting intra-Africa trade, and enabling industrialization, investment and job creation, thus enhancing the competitiveness of Africa in the medium to long term.

Infrastructure projects

The need for infrastructure improvements in Africa is critical. Faced with rapid urbanization and increasingly severe climate change impacts, African cities need greater access to technical and financial support. As one of the dedicated initiatives, on 2-3rd February 2023 the 2nd Dakar Financing summit for Africa's Infrastructure Development was held in Dakar, co-hosted by the African Union Development Agency and the Government of Senegal.

The 69 projects, which come from all five of Africa’s regions, are being implemented by regional bodies and unions, including ECOWAS, COMESA and SADC, and should be completed by 2030.

The projects that fall under the Programme for Infrastructure Development in Africa (PIDA), a blueprint for infrastructure development to increase Africa's competitiveness and economic integration, include:

· The Transborder Submarine Fiber point of presence and Regional Smart Hub Facility and Data center project, which will provide ICT connectivity to 285 million people in Ethiopia, Kenya, Somalia, South Sudan, Tanzania, and Uganda.

· The Gambia River Basin Development Organization Energy Project (OMVG Energy Project), which involves 4 countries: Gambia, Guinea, Guinea-Bissau and Senegal. It focuses particularly on the rational management of the joint resources of Rivers Gambia, Kayanga-Géba and Koliba-Corubal, whose basins have power-generating potential.

The Baynes Hydropower project, an energy project that will benefit Angola, Botswana, the Democratic Republic of the Congo, Eswatini, Lesotho, Malawi, Mozambique, Namibia, South Africa, Tanzania, Zambia, and Zimbabwe, and others.

The lead financier of these projects is African Development Bank that has already provided over $7 billion, with more than 50% of total financing secured.

One of the best-known projects the African Development Bank supports is the Abidjan-Lagos Highway project, valued at $15.6 billion. The 1,081-kilometer Abidjan- highway will link Abidjan to Lagos, via Accra, Lomé, and Cotonou along the West African coast. The Abidjan-Lagos axis covers nearly 75% of West Africa's commercial activities.

AfCFTA – the African Continental Free Trade Area

The African Continental Free Trade Area (AfCFTA) is Africa’s most ambitious integration initiative and a flagship project of Agenda 2063 of the African Union — Africa’s own development vision. It brings together the 55 countries of the African Union (AU) and eight (8) Regional Economic Communities (RECs). It was approved by the 18th ordinary Session of Assembly of Heads of State and Government, held in Addis Ababa, Ethiopia in January 2012 which adopted the decision to establish a Continental Free Trade Area.

The AfCFTA aims at accelerating intra-African trade and boosting Africa’s trading position in the global market by strengthening Africa’s common voice and policy space in global trade negotiations. The overall mandate of the AfCFTA is to create a single continental market with a population of about 1.3 billion people and a combined GDP of approximately US$ 3.4 trillion.

The objectives of the AfCFTA are the following:

· To create a single market for goods, services, facilitated by movement of persons to deepen the economic integration of the African continent and in accordance with the Pan African Vision enshrined in Agenda 2063.

· To create a liberalized market for goods and services through successive rounds of negotiations.

· To contribute to the movement of capital and natural persons and facilitate investments building on the initiatives and developments in the State Parties and RECs.

· To lay the foundation for the establishment of a Continental Customs Union at a later stage.

· To promote and attain sustainable and inclusive socio-economic development, gender equality and structural transformation of the State Parties.

· To enhance the competitiveness of the economies of State Parties within the continent and the global market.

· To promote industrial development through diversification and regional value chain development, agricultural development, and food security.

· To resolve the challenges of multiple and overlapping memberships.

The AfCFTA entered into force on May 30, 2019, after 24 Member States deposited their Instruments of Ratification following a series of continuous continental engagements spanning since 2012. The commencement of trading under the AfCFTA was on January 1, 2021.

The implementation of the AfCFTA comprises two phases:

Phase I:

· trade in goods

· trade in services

· dispute settlement mechanism

Phase II:

· investment

· intellectual property rights

· competition policy

· digital trade

· women and youth in trade

The AfCFTA will contribute to establishing regional value chains in Africa, boosting intra-Africa trade, and enabling industrialization, investment and job creation, thus enhancing the competitiveness of Africa in the medium to long term.

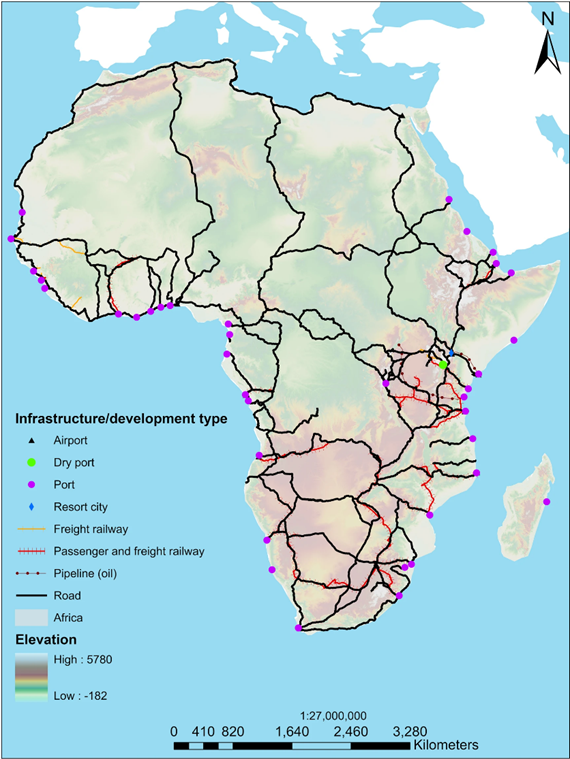

Infrastructure projects

The need for infrastructure improvements in Africa is critical. Faced with rapid urbanization and increasingly severe climate change impacts, African cities need greater access to technical and financial support. As one of the dedicated initiatives, on 2-3rd February 2023 the 2nd Dakar Financing summit for Africa's Infrastructure Development was held in Dakar, co-hosted by the African Union Development Agency and the Government of Senegal.

The 69 projects, which come from all five of Africa’s regions, are being implemented by regional bodies and unions, including ECOWAS, COMESA and SADC, and should be completed by 2030.

The projects that fall under the Programme for Infrastructure Development in Africa (PIDA), a blueprint for infrastructure development to increase Africa's competitiveness and economic integration, include:

· The Transborder Submarine Fiber point of presence and Regional Smart Hub Facility and Data center project, which will provide ICT connectivity to 285 million people in Ethiopia, Kenya, Somalia, South Sudan, Tanzania, and Uganda.

· The Gambia River Basin Development Organization Energy Project (OMVG Energy Project), which involves 4 countries: Gambia, Guinea, Guinea-Bissau and Senegal. It focuses particularly on the rational management of the joint resources of Rivers Gambia, Kayanga-Géba and Koliba-Corubal, whose basins have power-generating potential.

The Baynes Hydropower project, an energy project that will benefit Angola, Botswana, the Democratic Republic of the Congo, Eswatini, Lesotho, Malawi, Mozambique, Namibia, South Africa, Tanzania, Zambia, and Zimbabwe, and others.

The lead financier of these projects is African Development Bank that has already provided over $7 billion, with more than 50% of total financing secured.

One of the best-known projects the African Development Bank supports is the Abidjan-Lagos Highway project, valued at $15.6 billion. The 1,081-kilometer Abidjan- highway will link Abidjan to Lagos, via Accra, Lomé, and Cotonou along the West African coast. The Abidjan-Lagos axis covers nearly 75% of West Africa's commercial activities.

*Map showing the distribution of all the development corridors included in the African Development Corridors Database and their infrastructure type.

Source: Nature. Thorn, J.P.R., Bignoli, D.J., Mwangi, B. et al. The African Development Corridors Database: a new tool to assess the impacts of infrastructure investments. Sci Data 9, 679 (2022). https://doi.org/10.1038/s41597-022-01771-y

African Integrated High-Speed Railway Network

On of the most challenging infrastructure projects in Africa was presented by the African Union Development Agency-NEPAD (AUDA-NEPAD). It has released a video capturing the conception, design, and implementation plan for the African Integrated High-Speed Railway Network. The project is seen as part of implementing “Agenda 2063” and has seen completion of the technical feasibility study and consequent unprecedented construction and procurement decisions among the economic blocs and individual national governments.

The first three objectives of the project to be achieved by 2033 are:

· Interconnecting landlocked countries, connecting regions of Africa together and establishing Trans-Africa beltways.

· Realization of pilots: the Dar es Salaam-Kigali link combined with the Kampala-Kigali-Bujumbura, as well as the Walvis Bay-Windhoek-Gaborone-Pretoria.

· Identification of ten other regional pilots that will be subjected to feasibility assessment as soon as possible.

The planned network will connect the 16 landlocked countries in Africa to major seaports and neighboring countries. It will establish interoperability of railways across different regions, create East-West / North-South land-bridges and interconnect African capitals. This will help the interconnection of major commercial and economic hubs to boost economic growth and intra-African free trade, as well as complement the African Continental Free Trade Area.

Africa’s Space industry

The establishment of the Africa Agenda 2063 by the Heads of State and Government of the African Union (AU) in January 2015 announced Africa’s entrance to the global space arena. This push to unify continental efforts in the space domain, culminated in October 2017, when the AU published a draft statute for the development of an African Space Agency (AfSA), as well as the African Space Policy and Strategy.

The main goals of the African Space Policy and Strategy are:

· To create a well-coordinated and integrated African space programme that is responsive to the social, economic, political, and environmental needs of the continent, as well as being globally competitive.

· To develop a regulatory framework that supports an African space programme and ensures that Africa is a responsible and peaceful user of outer space.

As a continuation of this course taken, the African Space Agency (AfSA) was inaugurated on January 25, 2023.

The main goals of AfSA are:

· To promote and coordinate the implementation of the African Space Policy and Strategy.

· To conduct activities that exploit space technologies and applications for sustainable development and improvement of the welfare of African citizens.

The space industry in Africa is slowly gaining traction with the help of new technologies. One of such examples is SpaceX smallsat rideshare program which provides affordable cost of access. As of December, 52 satellites had been launched by 14 African countries, with Uganda and Zimbabwe sending theirs in November. In April 2023, also Kenya launched its first ever operational earth observation satellite, becoming the latest African nation to achieve the milestone in the continent’s nascent space industry.

Kenya’s Taifa-1 was designed and developed by local engineers in collaboration with Bulgarian firm EnduroSat and was among the dozens of spacecrafts carried by SpaceX’s Falcon 9 rocket that lifted off from California. Images from the spacecraft will provide a wide array of data, including information related to climate-linked challenges, boost the government’s efforts in improving food security, forestry and offer insights to land-use planners.

Conclusions

The recent unfavorable global conditions have led to rising inflation, higher debt servicing costs and increased risk of debt distress in developing countries, including Africa. It has also become difficult for African countries to access international capital markets for new financing. Despite the slowdown occasioned by multiple shocks, African economies remain resilient with a stable outlook in 2023-2024. The continent remains a treasure trove for smart investors globally, but it must strive for more inclusive economies and greater resilience to external shocks. Africa could take advantage of its population to grow a robust single market that would enable it to position itself among the three largest global marketplaces.

The African continent’s population is projected to reach 2.5 billion people by 2050 and will become the largest workforce globally. With its ‘Agenda 2063’, the African Union has established an ambitious strategy for a prosperous Africa based on inclusive and sustainable development. Agenda 2063 is a strategic framework for the socio-economic transformation of the continent. The start of the African Continental Free Trade Area (AfCFTA) in 2021, a flagship project within Agenda 2063, is a huge milestone towards accelerating intra-Africa trade and boosting Africa’s position in the global economy. AfCFTA promises a EUR 1 billion consumer market to African businesses and more than EUR 3.3 trillion in investment in consumer spending by 2030. Producing more goods regionally will make African economies more resilient. If implementation challenges are tackled and overcome, it could transform the African continent’s economic prospects. Under Agenda 2063, African governments tasked themselves with achieving at least 7% growth per year to catch up with the rest of the world, create jobs and reduce inequalities. This is an opportunity for Africa to become an integrated, peaceful, and prosperous continent, which plays a major role in the global arena.

Source: Nature. Thorn, J.P.R., Bignoli, D.J., Mwangi, B. et al. The African Development Corridors Database: a new tool to assess the impacts of infrastructure investments. Sci Data 9, 679 (2022). https://doi.org/10.1038/s41597-022-01771-y

African Integrated High-Speed Railway Network

On of the most challenging infrastructure projects in Africa was presented by the African Union Development Agency-NEPAD (AUDA-NEPAD). It has released a video capturing the conception, design, and implementation plan for the African Integrated High-Speed Railway Network. The project is seen as part of implementing “Agenda 2063” and has seen completion of the technical feasibility study and consequent unprecedented construction and procurement decisions among the economic blocs and individual national governments.

The first three objectives of the project to be achieved by 2033 are:

· Interconnecting landlocked countries, connecting regions of Africa together and establishing Trans-Africa beltways.

· Realization of pilots: the Dar es Salaam-Kigali link combined with the Kampala-Kigali-Bujumbura, as well as the Walvis Bay-Windhoek-Gaborone-Pretoria.

· Identification of ten other regional pilots that will be subjected to feasibility assessment as soon as possible.

The planned network will connect the 16 landlocked countries in Africa to major seaports and neighboring countries. It will establish interoperability of railways across different regions, create East-West / North-South land-bridges and interconnect African capitals. This will help the interconnection of major commercial and economic hubs to boost economic growth and intra-African free trade, as well as complement the African Continental Free Trade Area.

Africa’s Space industry

The establishment of the Africa Agenda 2063 by the Heads of State and Government of the African Union (AU) in January 2015 announced Africa’s entrance to the global space arena. This push to unify continental efforts in the space domain, culminated in October 2017, when the AU published a draft statute for the development of an African Space Agency (AfSA), as well as the African Space Policy and Strategy.

The main goals of the African Space Policy and Strategy are:

· To create a well-coordinated and integrated African space programme that is responsive to the social, economic, political, and environmental needs of the continent, as well as being globally competitive.

· To develop a regulatory framework that supports an African space programme and ensures that Africa is a responsible and peaceful user of outer space.

As a continuation of this course taken, the African Space Agency (AfSA) was inaugurated on January 25, 2023.

The main goals of AfSA are:

· To promote and coordinate the implementation of the African Space Policy and Strategy.

· To conduct activities that exploit space technologies and applications for sustainable development and improvement of the welfare of African citizens.

The space industry in Africa is slowly gaining traction with the help of new technologies. One of such examples is SpaceX smallsat rideshare program which provides affordable cost of access. As of December, 52 satellites had been launched by 14 African countries, with Uganda and Zimbabwe sending theirs in November. In April 2023, also Kenya launched its first ever operational earth observation satellite, becoming the latest African nation to achieve the milestone in the continent’s nascent space industry.

Kenya’s Taifa-1 was designed and developed by local engineers in collaboration with Bulgarian firm EnduroSat and was among the dozens of spacecrafts carried by SpaceX’s Falcon 9 rocket that lifted off from California. Images from the spacecraft will provide a wide array of data, including information related to climate-linked challenges, boost the government’s efforts in improving food security, forestry and offer insights to land-use planners.

Conclusions

The recent unfavorable global conditions have led to rising inflation, higher debt servicing costs and increased risk of debt distress in developing countries, including Africa. It has also become difficult for African countries to access international capital markets for new financing. Despite the slowdown occasioned by multiple shocks, African economies remain resilient with a stable outlook in 2023-2024. The continent remains a treasure trove for smart investors globally, but it must strive for more inclusive economies and greater resilience to external shocks. Africa could take advantage of its population to grow a robust single market that would enable it to position itself among the three largest global marketplaces.

The African continent’s population is projected to reach 2.5 billion people by 2050 and will become the largest workforce globally. With its ‘Agenda 2063’, the African Union has established an ambitious strategy for a prosperous Africa based on inclusive and sustainable development. Agenda 2063 is a strategic framework for the socio-economic transformation of the continent. The start of the African Continental Free Trade Area (AfCFTA) in 2021, a flagship project within Agenda 2063, is a huge milestone towards accelerating intra-Africa trade and boosting Africa’s position in the global economy. AfCFTA promises a EUR 1 billion consumer market to African businesses and more than EUR 3.3 trillion in investment in consumer spending by 2030. Producing more goods regionally will make African economies more resilient. If implementation challenges are tackled and overcome, it could transform the African continent’s economic prospects. Under Agenda 2063, African governments tasked themselves with achieving at least 7% growth per year to catch up with the rest of the world, create jobs and reduce inequalities. This is an opportunity for Africa to become an integrated, peaceful, and prosperous continent, which plays a major role in the global arena.